On 1 July 2014, new regulations come into force in case goods are imported to Switzerland by travelers. The aim of those new rules is to simplify touristic traffic and make it more transparent.

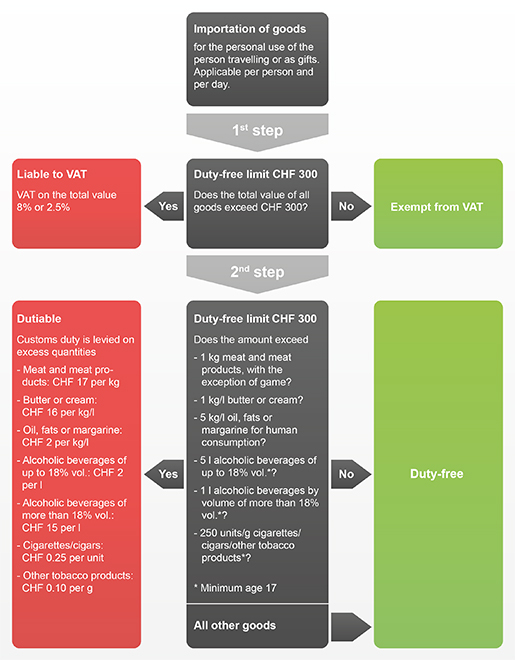

From now on, travelers attempting to import goods into Switzerland are required to answer two questions:

(1) Does the total value of all goods exceed CHF 300?

(2) Are defined duty free limits exceeded?

In the case both questions are denied, no taxes are due. If one or both of the questions may be positively answered, either VAT or/and customs duties are due.

Most Important Changes

Value Added Tax:The import VAT free limit of CHF 300 will not be changed. But from now on, alcoholic beverages as well as tobacco products have to be added to total value of all goods.

Customs Duties:The duty free limits have been partly changed. For example, from now on 5 liters of Wine (Alcohol volume up to 18% vol.) per day and person as from 17 years might be imported into Switzerland being exempt from duties. So far, 2 liters have been allowed. In addition, pay scale groups have been summarized and reduced.

In the future, it should be possible to electronically register goods in movement of travelers (for example on smartphones or tablets).

On the following page, a scheme of the Federal Tax Administration is demonstrating the new regulations:

Contact:

Simeon L. Probst

Director VAT & Customs

Tel.: +41 58 792 53 51

Email: simeon.probst@ch.pwc.com