A few years ago, I had the pleasure of visiting the Immigration Museum in New York. It was a fascinating yet eerie experience. Imagine trying to escape hunger and poverty by emigrating from Europe to the United States. After weeks aboard a ship on rough seas, you finally arrive in New York. The authorities conduct various tests and then inform you that one member of your family cannot enter the country and must return to Europe. What would you do? Would you all go back together? Would you send the person back alone, or would you split up? These were the questions I asked myself back then, and to this day, I still recall the unease I felt in that exhibition in New York as I tried to put myself in that situation.

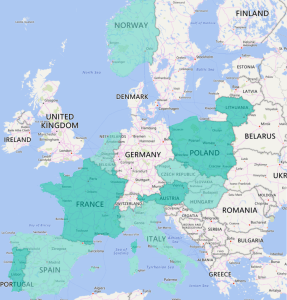

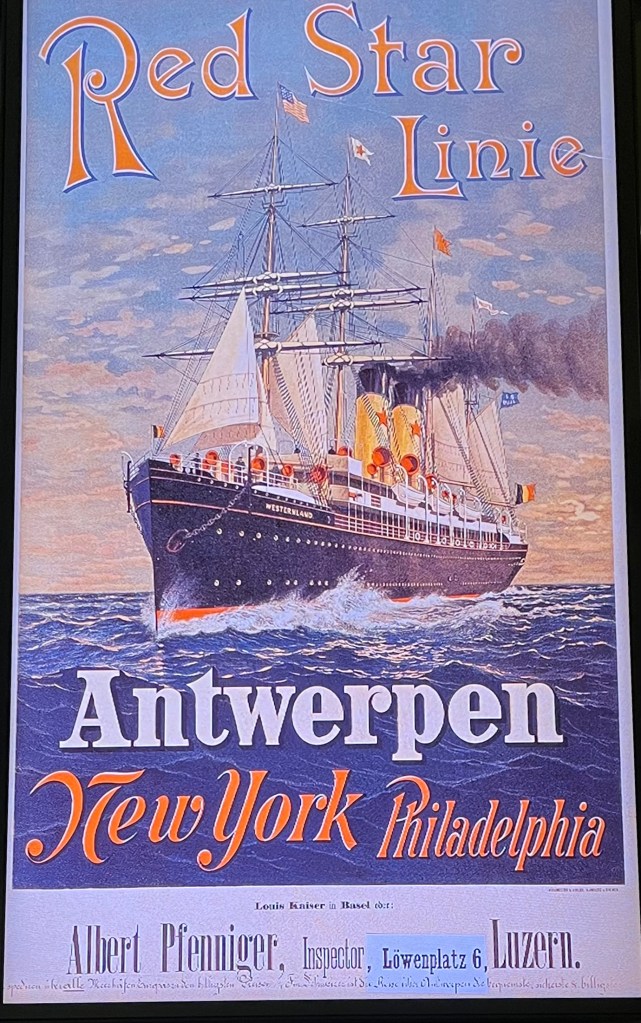

Now, I’m spending a weekend in Antwerp and visiting the Red Star Line Museum. This museum tells the

story of the starting point for many emigration journeys from Europe to America. Countless Europeans embarked for America from Antwerp, driven by the same reasons people migrate today: lack of economic opportunities, poverty, and persecution. The museum, located in the port area, is definitely worth a visit, and it was here that I heard one of the most breathtaking stories from our tour guide.

The story is about the Bobelijn family. The father emigrated to the USA first, while the mother stayed in Europe with three boys and little Irene. After the father had settled in the USA, he sent for his family. The mother and her four children boarded a Red Star Line ship bound for the USA. The journey in third class was far from a vacation: cramped conditions, no privacy, monotonous food, and perhaps even seasickness. Upon arriving in New York, eight-year-old Irene was diagnosed with a contagious eye disease. She was not allowed to enter the USA, while the rest of the family was granted entry.

Imagine having to make such a decision: Your husband, whom you haven’t seen for years, is waiting for you on the shore, and you must decide whether to return to Europe with everyone and try again later or send little Irene back alone. An option where the boys joined their father while the mother stayed with Irene was not allowed, as the authorities would not permit unaccompanied minor boys to enter the country. What would you have done?

The mother sent little Irene back to Antwerp alone. A year later, Irene tried again, but she was rejected and had to return once more. She lived another four years with a foster family, and it wasn’t until her third attempt that she was finally allowed to enter the USA. A true nightmare for any child and family. Stories like this likely still happen every day in various forms, though they are often unimaginable to us. Perhaps, 80 years from now, our descendants will hear about the stories of today.

It was also fascinating to learn that the Red Star Line had a European sales network for ticket distribution. In Switzerland, the office was located in Lucerne. If you have ancestors who emigrated to America, you can search for them in digitized archives.

Antwerp was a true discovery for me. It’s a city well worth visiting. For example, the numerous Rubens paintings in the incredibly vast cathedral, the lively old town, the relaxed atmosphere despite the crowds, the fact that in November people still eat, play cards, discuss, and laugh outdoors late into the night, the harbor, the museums, the impressive train station hall, the countless fascinating buildings in the city, as well as the many restaurants and museums. If you have a few days, Antwerp is highly recommended—even in the fog.